Personal

Bankruptcy Law

Assisting individuals with Chapter 7 & Chapter 13 bankruptcy proceedings.

Our Bankruptcy Attorneys

Cunningham Dalman has bankruptcy attorneys who specialize in assisting individuals and businesses.

Personal Bankruptcy Attorney in Holland, Michigan

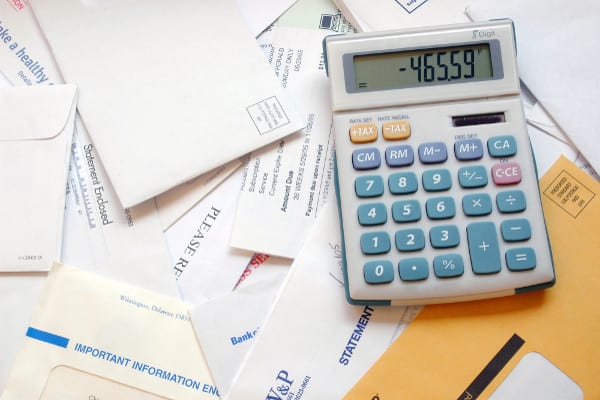

We know that personal bankruptcy can be an emotional and painful process, whether you file for bankruptcy protection yourself, or are affected by someone else who has filed. A competent personal bankruptcy lawyer is adept at answering the multitude of questions that arise. What debts can be discharged? Will I lose my house? What property can I keep?

Contemplating Personal Bankruptcy?

If you are contemplating filing for personal bankruptcy, Cunningham Dalman’s Bankruptcy Law Practice Group in Holland, Michigan has the experience and knowledge to advise and represent you in this important step in your personal life. Our attorneys will assist you in determining if bankruptcy is your best course of action or if other forms of relief may better fit your personal situation.

Voted Best Law Firm in Holland, Michigan

Attorney Articles

Is It Sometimes Better Not Knowing?

Is it ever better for someone to not know about something that’ll benefit them? In some cases, that’s true and

Why Flat Fee Agreements Are a Smart Choice for Criminal Defense

If you’ve been charged with a crime in Michigan, the uncertainty ahead can feel daunting—especially when it comes to legal

Michigan’s Earned Sick Time Act: What Employers Should Know

As of today, Friday, February 21, 2025, Michigan’s Earned Sick Time Act (ESTA) is scheduled to take effect. Guidance on

Are You Looking for Corporate Bankruptcy Assistance?

Personal Bankruptcy Law

Is Bankruptcy the Right Option for You?

Our attorneys assist individuals every day with evaluating their options. Each situation is unique and sometimes non-bankruptcy steps may be your best approach. Bankruptcy law in Michigan can be complex and it's best to walk this path with experienced counsel.

Read MoreChapter 7 Bankruptcy

Chapter 7 is the most common type of personal bankruptcy and is often called "liquidation" or "straight" bankruptcy. Our attorneys can assist you in understanding the process and the best way of approaching your individual situation. In our experience, it's best to hire counsel before you begin this process.

Chapter 7Chapter 13 Bankruptcy

If you have enough income to repay a portion or all of your debts, you may be able to restructure your obligations and submit a payment plan to the bankruptcy court. Our attorneys are well versed in Michigan bankruptcy law and how to prepare your case.

Chapter 13Bankruptcy with Business Involved

If you own a business, personal bankruptcy can affect it. Our attorneys can assist in reviewing your business structure and help you decide on the best overall approach.

BusinessBankruptcy of Others - Protecting Yourself

Unfortunately, there are times when a former spouse or a business partner may have to file Chapter 7. Our attorneys are here to assist you in protecting your interests.

ProtectionPersonal Bankruptcy Attorneys in Holland

You may need assistance. Let our team help you navigate the court system.

Personal Bankruptcy: Understanding all of your options

Is Bankruptcy the Right Option?

Unfortunately, there are times in our life when unexpected events occur, and we face financial challenges. In fact, it’s estimated that over 70% of bankruptcy filings are connected to unexpected medical expenses. The second biggest reason individuals file is related to credit debt resulting from job loss, an illness keeping your out of the workforce, and emergency expenses.

The good news is that bankruptcy isn’t the only choice. Our attorneys are here to discuss your options and assist you in deciding on the best path forward.

Alternatives to Bankruptcy:

- Debt Settlement - Our skilled attorneys can assist in negotiating settlements with your creditors and fully understand the debt collection process. Sometimes creditors may be willing to settle the debt for a discount so as to avoid the entire obligation being discharged in a Chapter 7 filing.

- Debt Counseling vs. Chapter 13 Repayment Plans - Individuals can work with debt counseling agencies to pay back creditors over time, and although such repayment plans are similar to Chapter 13 plans, there are some important differences. If you miss a payment negotiated by a debt counseling agency, creditors can begin the collections process again immediately, whereas the automatic stay in Chapter 13 provides additional protections. In addition, Chapter 13 may allow for a significant discount in repaying unsecured debts.

Personal bankruptcy: Is chapter 7 the best option for you?

Chapter 7 Bankruptcy

Areas of Assistance:

-

Bankruptcy Means Test - A bankruptcy filing may require completion of the "means test". The means test is a formula used in bankruptcy to objectively evaluate your financial situation and decide if Chapter 7 or Chapter 13 is more appropriate. The "means test" first looks at your income for the prior six months compared with the state's median income. If you are below the median for the last six months, there's a good chance you'll be allowed to file Chapter 7.

If you don't pass the median income requirement, you'll need to complete step two which is a more thorough review of your spending. You will be required to list out your expenses for essentials like food, mortgage / rent, clothes, and medical bills. Our attorneys have experience in walking individuals through this process and ensuring you understand each portion. - Non-Dischargeable Debts - These are debts you cannot discharge by filing bankruptcy. These can include such items as: most taxes, most student loans, support obligations such as child support and alimony, court fines and restitution, fraud and some types of personal injury debts.

- Chapter 7 Filing - Our attorneys will help you pull together the necessary information you'll need, will prepare your case, and fill out the necessary paperwork. We will assist you in preparing you for the meeting of creditors and represent you at this hearing. Our bankruptcy team of attorneys will ensure you are kept up-to-date throughout the process.

personal bankruptcy: could chapter 13 be a better option?

Chapter 13 Bankruptcy

Areas of Assistance:

- Common Reasons for Filing Chapter 13 - Two of the most common reasons for using Chapter 13 is to stop home foreclosures and auto repossessions. Repayment plans allow you to pay off back-mortgage payments and restructure an auto loan in order to keep the vehicle. Chapter 13 can also be helpful in freezing interest & penalties associated with non-dischargeable debts (typically government debts such as taxes).

- Credit Counseling Requirements - In Michigan, you are required to complete two separate bankruptcy courses. Our attorneys will help you find an approved provider. You can take these courses online for a small fee and the courses usually take 2 hours or less.

- Chapter 13 Filing Preparation - Chapter 13 filings can be lengthy and do take preparation. Our bankruptcy attorneys will assist you in gathering all of the required information on income, debts, bankruptcy exemptions, personal property, real estate, co-debtors, leases, and expenses.

- Chapter 13 Filing - Our team will prepare and file your bankruptcy forms and attend all necessary court hearings with you such as the "First Meeting of Creditors". This is a hearing with the bankruptcy trustee assigned to your case that creditors may attend. It is important to be properly prepared for this hearing and we will help you prepare and competently present at this hearing.

personal bankruptcy: understanding how bankruptcy court views your business

Filing Bankruptcy When You Own a Business

Personal bankruptcy will affect your business and will be largely dependent upon how your business entity is structured (Sole Proprietorship, Partnership, LLC, or Corporation). For sole proprietors, legally you are the business and any asset could be considered for settling debts. For partnerships, business assets will normally be limited to your interest or partnership level.

In these situations, we kindly ask you to invest in our services before venturing down this path. Our bankruptcy team can engage our Business & Corporate Law practice if additional expertise is required for your situation.

Common Topics or Concerns:

- Should Your Business File for Bankruptcy at the same time? - If your business structure is a partnership, corporation or limited liability company, we can help you evaluate and determine if your business should pursue its own debt relief options. Businesses also have the option of filing Chapter 7 or Chapter 11. In certain situations, it may be in your best interest to file Chapter 7 personally but then file Chapter 11 to keep your business running. If you have a business, we suggest you discuss your options with an experienced bankruptcy attorney.

- Inside Creditors - Bankruptcy courts treat business owners as “insider” creditors and it’s important you understand this concept. If your business files a bankruptcy case, certain payments to yourself from the business, such as bonuses, loan repayments or other transfers of money or assets out of the business, can be treated as “preferential transfers” which must be repaid. Preference payments can also apply to money borrowed from and repaid to friends and/or family by the business before the bankruptcy filing. Our bankruptcy attorneys have considerable experience with navigating these kinds of avoidable transfer issues.

personal bankruptcy: Understanding how to protect yourself

Bankruptcy of Others - Protecting Yourself

Unfortunately, you may find yourself in a situation where a former spouse or a business partner is having to file bankruptcy and your name is on a joint loan or account. Our bankruptcy attorneys see all types of situations and look to protect your interests in these situations.

Expertise in Multiple Areas:

- Proof of Claims - If a creditor will be paid through the bankruptcy, they are generally required to file a “Proof of Claim” listing the details. We can help you navigate this process.

- Protecting Assets - Our team can assist you in obtaining adequate protection for liens, mortgages, and collateral that secure your debt.

- Defending Against a Trustee's Claims - We can assist you whether the trustee claims that you received fraudulent transfers, preferential transfers, seeks to avoid your lien, or presents some other type of claim.

- Relief from the Bankruptcy Stay - An automatic stay protects debtors in bankruptcy, and sometimes non-filing co-obligors on debts. In certain instances creditors and other interested parties can be entitled to relief from the automatic stay in order to, for example, enforce security agreements, mortgages and other liens against the debtor’s property, or continue a pre-bankruptcy lawsuit against the debtor for recovery of insurance proceeds. We can evaluate whether you may be entitled to relief from the automatic stay, and help you seek such relief from the bankruptcy court.

- Avoiding Debtor's Discharge in Bankruptcy - If you extended credit to a debtor based upon a misrepresentation or fraud, if the debtor violated the Michigan Building Contract Fund Act, if the debt owed to you is for child support, alimony or criminal restitution, or a personal injury debt arising out of a drunk driving accident, the debt owed to you may be non-dischargeable in bankruptcy. We can assist you in determining whether the obligation owed to you may be non-dischargeable, and filing the necessary paperwork with the bankruptcy court.

Personal Bankruptcy FAQs

Most frequent questions and answers

This will depend upon your individual circumstances. Chapter 7 is the most popular filing but you must qualify via the “means test”.